Fifty billion dollars. That is the most recent figure for U.S. yearly spending on foreign aid. However, even though this aid goes to over 200 countries, the vast majority is received by a select few. So how does the U.S. determine which nations get this massive amount of funding, when it is received, and what is the most effective way to utilize it?

Robert Brent saw the impact of foreign aid firsthand while working in the Africa Bureau of the United States Agency for International Development (USAID) and later cooperating with the Millenium Challenge Corporation. These positions gave him a view of the different criteria that the U.S. uses to select the countries that receive this aid. He argues that these criteria are inherently flawed, and ultimately do little to incentivize growth within developing nations. As evidence, he examines notable successes of economic reform—whether historical and U.S.-assisted as in South Korea and Taiwan, or the singular modern example of China. These examples provide a way forward for foreign aid policy: one that focuses more on land reform and the growth of industry and less on meeting specific democracy and governance indicators that dominate USAID concerns today.

ADST relies on the generous support of our members and readers like you. Please support our efforts to continue capturing, preserving, and sharing the experiences of America’s diplomats.

Robert Brent’s interview was conducted by Carol Peasley on July 9, 2018.

Read Robert Brent’s full oral history HERE.

Drafted by Ty Ashton Ehuan.

Excerpts:

“In practice, we don’t have any Type A countries.”

Who Deserves Aid: . . . there was an attempt to rank countries by how well they looked in terms of quality of their economic policies . . . . Now, in theory, a good performer should be somebody that’s growing fast with equity, right? No, a good performer is somebody that scores well on the indicators we give them. We rank them, we tell them whether they’re a good performer or not. Okay, you can do that, but is your model that they are suddenly going to jump from where they are to good institutions in absolute terms? Of course not. So that’s the dilemma. And that tension still exists in the Millennium Challenge Account, which defines good performers very explicitly in terms of input indicators . . . .

One thing that was controversial was how to treat democracy. Because originally the only hard hurdle was corruption, which was decided by President Bush. You couldn’t be below the median

on corruption. That by itself would fail you. Political rights were one of the indicators, but not a hard hurdle.

But later, because of the Administration’s freedom agenda, they made political rights (above the median) a tacit hard hurdle (and I believe later a formal hard hurdle). That hit Rwanda. Rwanda scores well on most of the indicators, but not political rights. So this turned out to be pretty important, especially if we go back to our East Asian cases since none of them were democracies at the time that they did their growth pushes . . . .

And it makes this whole thing of “what is the role of foreign aid?” very dicey. Because, in theory, what you would like to do is find countries that have strong growth commitments and help them. I and a bunch of AID people went to hear a talk by Bill Easterly, and he said aid donors should look for Type A countries that have strong growth commitments and only aid them; aid to anyone else is wasted. We said, “Can you give us the name of one Type A country?” He could not. This is the problem. El Salvador looks great on the MCC indicators, but El Salvador’s got all these other issues going on. In practice, we don’t have any Type A countries. So what do you do in the meantime, and what is the purpose of foreign aid?

“Business development does not happen naturally. Governments have to help build it.”

Incentivizing Reform:

Q: One of the things that’s often said is the incentive factor—that the MCC threshold indicators provide some incentive for countries. Do you have views on that?

BRENT: Yeah, I don’t think it does. What I did see get affected was one of the indicators—days to start a business—because government could change that one indicator pretty easily. But as far as bigger policy changes to qualify for the MCA, I don’t think you can demonstrate that. In my view, that was not due to failures by MCA but to the limitations of the preconditions model itself. We don’t measure good performance by growth performance, or poverty reduction, or equity. We measure good performance by compliance with a set of indicators—which are input indicators, institutional descriptors—that we have constructed. If you do well by our test, we declare you a good performer, regardless of how well your economy is doing, how severe the obstacles are that you are facing. I just don’t think that’s the way growth happens. Also some countries that are doing pretty well on growth and poverty reduction don’t pass the indicator tests, like Rwanda.

In my view, economic reform is a fine thing; but it’s not the way countries make essential changes. They make essential changes by committing to a growth path, and reforms are a means to that end. We seem to want people to become perfect reform cases first and then expect that somehow business development just happens. It’s very much Adam Smith—all that is requisite is peace, easy taxes, and a tolerable administration of justice. All else follows naturally. Business development does not happen naturally. Governments have to help build it.

“You have to have a government that is dedicated to national growth. It has to be willing to sacrifice.”

The Role of Foreign Aid: We never really found a way to integrate this into USAID programs. The closest we came was the support for private sector development—which to this day tends to be a theme that Republicans embrace. Private sector development is related, but it’s not the same thing as East Asian development states and neo-mercantilist promotion of manufactured exports, à la Korea or Taiwan. That was really the model. And people had trouble understanding it. The World Bank misinterpreted it systematically, and wrote an ill-informed report in 1993 that said it was all free market reforms, which it wasn’t.

. . . I’m thinking more industrial policy, transformation of the economy by export-led growth. And the problem is, not many people think that way. So in Pillsbury’s view it was just: was USAID pushing for reforms? Yes, it was doing that in all the cases, but the big impacts of a Korea or Taiwan were not the norm.

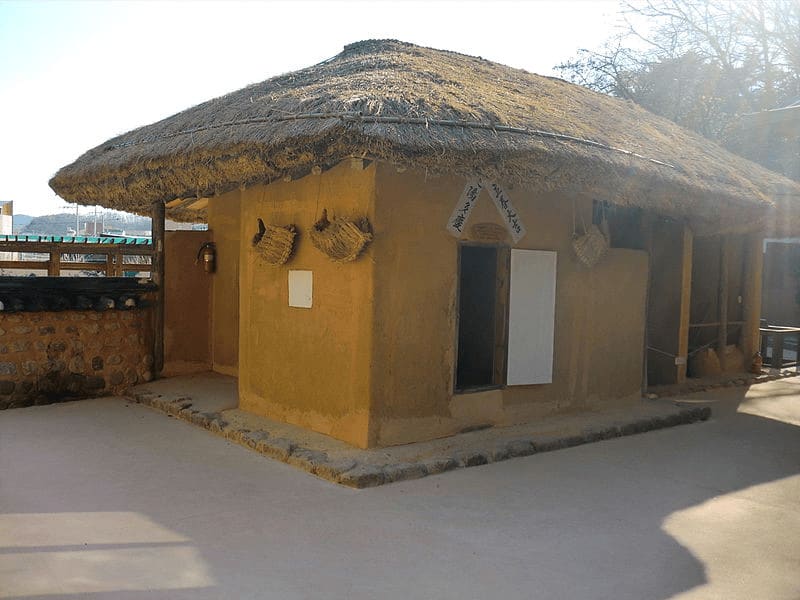

What Pillsbury was good at was showing AID as a force for progressive change in middle ground countries. That’s what most of Pillsbury’s examples are about. We haven’t had any major breakthroughs like Korea and Taiwan since then. Joe Studwell’s How Asia Works, which is another great book, says that even Indonesia, Malaysia, Thailand are not in that category. They were better than the Philippines, but not in the same class as Korea, Taiwan, Hong Kong, and Singapore. There really have only been six breakthrough cases. Those were Japan, Korea, Taiwan, Hong Kong, Singapore, and China. All of them did land reform, all of them did major industrial pushes, and all of them had major growth breakthroughs. Southeast Asian countries did some, but not the full Monty. And the Philippines has been much less successful. Most of the success stories are historical, except China. Which is why I think China is so important.

. . . Americans, and particularly conservatives, hate the idea of industrial policy. But the USG supported it in Korea and Taiwan, even in the White House. And those two countries are the cases that get cited as great USAID successes. So how you square this whole thing has been an ongoing issue in my mind ever since, and in the last five years I have become obsessed with how this is working in China. I have read every book I could find on China, and China is very much industrial policy, really a bit like Taiwan. Because Korea and Japan kept the foreign investment out; Taiwan had foreign investment in; and China has relied very heavily on foreign companies. So this saga has been building for decades, and is now, in the shape of China, back at the forefront. We still have trouble understanding it because it doesn’t fit with our paradigms.

. . . This gets into the essence of the model. Part of the East Asian model is land reform. And the reason land reform is so important is that you have to break the back of the elite landowners— which the Philippines has never done, and Korea and Taiwan both did, and Japan did. Now students of those argue that that was due to very special historical circumstances. Japan’s land reform was pressed by the United States. Korea’s was partly the same thing, and Taiwan had its own dynamics with the people coming over from China. But the point is there are political prerequisites. The government has to free itself from the old elites and be willing to support new industrial development policies. But this idea of picking winners, let’s just take one second on that.

General Park did not pick winners. General Park gave subsidies to all companies that met export quotas, and if they didn’t, he cut them off. He was using an export market test, and his strength was that he was willing to cut you off for non-performance. And he was willing to make big investments . . . . In the case of Korea, Park said, “Look, I may not love the chaebols, but they know how to export. Those are going to be my guys, and I’m going to go with them. I’ll have export quotas. If they don’t meet them, I’ll cut them off.”

He was a military guy. He didn’t like business people. At first he put a lot of them in jail, showed them who was boss. Then he started giving them money and said, “Do these exports.” And it worked. Then he made a big gamble on a massive push on heavy industry. The World Bank said, “We won’t give you money for that. It’s never going to work.” But Park went ahead anyway. It took 15 years before it really began to pay off. But that was the base for a lot of Korea’s later big industries.

Taiwan was a little different. Taiwan was led by technocrats. IT technocrats from America in the government saying, “Look, we’re going to build up an electronics industry.” A lot of U.S. companies helped them. That was almost more American assisted than Korea, but not necessarily American-conceived. Korea was more American-conceived.

So what is the common element of this? You have to have a government that is dedicated to national growth. It has to be willing to sacrifice. It has to gut the old feudal elite. It has to suppress consumption, and give out cheap capital as a way to subsidize the industrialization process. They all did that. Everybody had low consumption, high savings, cheap capital. They all undervalued their currencies. They all ran trade surpluses.

. . . But those things are hard to do. It’s hard to go to El Salvador and say, “You know, what would it take for you to do a Korea?” I brought this up with the South Africans when I was there, with ANC people, and they said, “We don’t want to do an East Asian low-wage strategy here. We want to make this economy work for black South Africans.” I said, “Okay, but you’re going to have a lot of unemployment.” So yeah, it’s talked about, but it’s kind of a thing where you either have to go full bore or you don’t go at all.

I found this in Egypt. The temptation is, let’s find some reformers and support them. What’s very hard to do is to be able to assess, is this country ready for change or not? And if it isn’t, there probably isn’t a lot you can do. And if it is, your impact is probably going to be incremental. It’s very hard to make this judgment when you’re on the scene, because we haven’t had any big success stories since the Tigers. Maybe the closest we have now are Rwanda and Ethiopia. But they haven’t had the kind of growth breakthroughs that Korea and Taiwan had.

“I’d almost pick a country in every region. Because regions need examples that they can relate to.”

Future Recommendations: I’d like to see an NGO ranking global leaders and governments. Those who are doing the best they can with the hands they have been dealt. Maybe that’s the way you do it today. Because we’re not going to have breakout cases today, I don’t think, like in the old days. For one thing, you have to compete against the China price. Nobody can beat China. Even Korea, if it were starting over today, couldn’t go against China.

. . . Aid can support social bases in a lot of places. But if you are going to go for economic growth, you have to focus on those that have strategies and political commitments to helping themselves. And look for branch points in the evolution of the country when change can happen. How do you find the time and people to get behind?

. . . and maybe that call has to be made from Washington. It will inevitably be linked with politics. I’d almost pick a country in every region. Because regions need examples that they can relate to. Would that be Jordan in the Middle East? I don’t know. Latin America? How about we stabilize one Central-American country. Or here’s another strategy. We say to the U.S. companies who are thinking about getting out of China, we want you guys to take a hard look at Mexico. Because we have a strong interest in Mexico’s economy growing solidly, so people will stay there and not come to the U.S. Mexico has some good technology and industry base in Monterrey. Build on that. Mexico’s wages are actually quite a bit below China’s at this point. This hits two birds with one stone: we put some pressure on China and we help Mexico. Or you can say, we are helping China achieve its objective of becoming less dependent on Western companies. The U.S. companies are already concerned about China, but they are slow to

move.

This could be part of a broader U.S. strategy. We build up the North America nexus—the U.S., Canada, and Mexico. Expand trade and investment in our backyard. China is on its way to dominating East Asia; there isn’t a lot we can do about that. But we could strengthen our base and they try to get Europe to lean our way, not to separate from China entirely, but to lean toward our side. That’s a strategy. That might include a major investment program with Mexico. Use aid for basic education and health paired with a major business investment program that would be the real incentive for them. It wouldn’t happen overnight, but if you stuck with it you could see real progress in 10 or 15 years.

TABLE OF CONTENTS HIGHLIGHTS

Education

BA in Economics, Duke University 1965–1969

MA in Public Policy, Harvard University 1976–1978

Ph.D in Public Policy, Harvard University 1978–1985

Joined USAID 1986

Washington, D.C.—USAID Africa Bureau 1986–1992

South Africa—USAID 1992–1999

Egypt—USAID Human Resources Associate Mission Director 1999–2003